The 30-Second Trick For "Demystifying Reconciliation Bank Account: What Every Entrepreneur Should Know"

Demystifying Reconciliation Bank Account: What Every Business owner Need to Recognize

As an business owner, handling your funds effectively is important for the effectiveness of your service. One important component of financial control is bank profile getting back together. This process makes sure that the deals taped in your publications match the deals recorded by your banking company, helping you recognize any discrepancies and keep accurate economic records.

In this post, we are going to debunk the concept of settlement banking company account and highlight why it is crucial for every business owner to comprehend and carry out it in their company operations.

What is Bank Account Reconciliation?

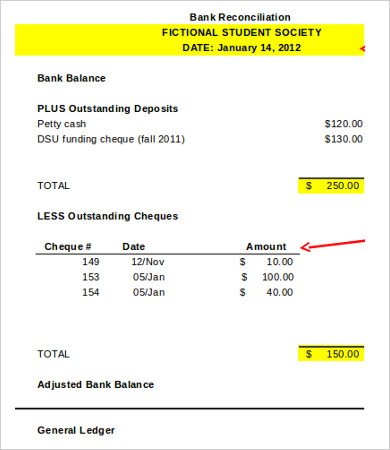

Banking company profile settlement is the method of matching up and matching the transactions taped in a business's profile records along with those demonstrated in its banking company claim. The objective is to make certain that each collection of documents line up, therefore pinpointing any kind of differences or inaccuracies that might have occurred throughout financial purchases.

Why is Bank Account Reconciliation Important?

1. Precision: Fixing up your financial institution accounts routinely makes certain that your economic records effectively reflect all purchases produced by your service. It helps pinpoint any sort of errors or omissions that may have occurred while recording these deals, permitting you to fix them promptly.

2. Fraud Discovery: By matching up your profile reports with the bank declaration, you can discover any type of illegal activities such as unwarranted drawbacks or shaped examinations. Timely id of such disparities enables you to take prompt activity to alleviate further loss or damage.

3. Cash Flow Management: Financial institution profile settlement gives knowledge in to the genuine cash money readily available in your company accounts, aiding you manage money circulation successfully. Through reviewing the tape-recorded harmonies with genuine balances, you may make sure appropriate allocation of funds and stay away from overdrafts or other cash-related concerns.

4. Economic Reporting: Precise financial record is crucial for helping make informed company choices and attracting potential clients or financial institutions. Resolving your financial institution profiles makes certain that all monetary statements are located on exact information, improving reliability and transparency.

How to Do Bank Account Reconciliation?

1. Collect Documentation: Pick up all appropriate papers, including banking company declarations, canceled inspections, deposit slips, and profile documents such as standard ledgers and cash money diaries.

2. Compare Beginning Equilibriums: Begin by reviewing the starting equilibrium of your bank declaration along with the finishing equilibrium from the previous reconciliation period. They ought to match; otherwise, investigate and repair any sort of discrepancies.

3. Match Transactions: Go with each deal provided on your banking company declaration and review it along with the corresponding entry in your profile reports. Mark each transaction as reconciled once you have confirmed its precision.

4. Identify Disparities: If you find any kind of discrepancies between your files and the bank statement, check out them to identify the cause. Popular factors for discrepancies include time distinctions, errors in recording transactions, or financial institution inaccuracies.

5. Adjust Access: Once you have determined the reason of a inconsistency, make needed changes to repair it in both your accounting records and banking company declaration.

6. Integrate Ending Equilibriums: After matching all transactions and creating adjustments if required, match up the finishing equilibrium of your financial institution declaration with that worked out using your profile documents. They ought to be equivalent; or else, customer review for any kind of forgotten entrances or errors.

7. File Settlement: Maintain a document of all getting backs together conducted along with sustaining information to ensure traceability and provide as evidence during audits or inspections.

Verdict

Bank profile settlement is a crucial method for business people aiming to preserve precise economic files and effectively take care of their service funds. By regularly contrasting This Is Noteworthy with their bank statements, business owners can determine inconsistencies immediately, identify frauds early on, take care of cash money circulation effectively, and supply correct financial reporting.

Implementing proper settlement strategies not just makes sure exact financial data but also helps build trust one of stakeholders such as investors or loan providers who depend on these documents when making decisions concerning potential collaborations or funding opportunities.

As an entrepreneur dedicated to long-term excellence in organization operations, understanding and applying helpful settlement procedures are going to undoubtedly add to much better economic monitoring in general.